By Richard Evans, telegraph.co.uk

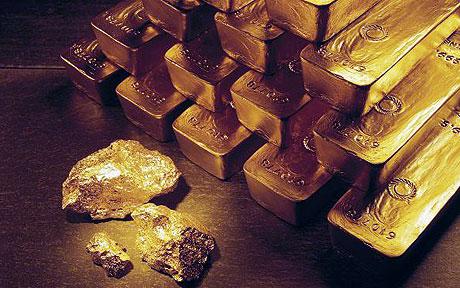

Not owning gold during the current financial turmoil is “a form of insanity”, according to an investment analyst at a leading City firm.

Robin Griffiths, a technical strategist at Cazenove Capital, told CNBC: “I think not owning gold is a form of insanity. It may even show unhealthy masochistic tendencies, which might need medical attention.”

Robin Griffiths, a technical strategist at Cazenove Capital, told CNBC: “I think not owning gold is a form of insanity. It may even show unhealthy masochistic tendencies, which might need medical attention.”

He added that the dollar was heading for “oblivion”.

Mr Griffiths predicted that gold’s 10-year bull run would continue and even intensify. “Although it’s been a top performer for each of the last 10 years, it’s still in a linear trend,” he said. “Eventually it will go exponential and make more in the last little bit than the whole of the 10-year trend.”

He said investors should regard any short-term falls in the gold price as a buying opportunity, adding that gold was still not an “over-owned trade”.

His comments come against the background of the US Federal Reserve’s huge monetary stimulus from quantitative easing, which many believe will result in inflation and a fall in the value of the dollar.

“The downward trend in the dollar is awesomely powerful,” Mr Griffiths said. “It’s vital to get yourself out of the dollar long-term on any significant rally. Continuing to own a currency that is going to be printed virtually into oblivion ? that’s the official policy ? is crazy.”

He added: “Real assets hedge paper money being printed into oblivion, so you’ve got to own gold and you’ve got to own other commodity-related investments still.”