Via moneynews.com

A ?perfect storm? of fiscal woe in the U.S., a slowdown in China, European debt restructuring and stagnation in Japan may converge on the global economy, New York University professor Nouriel Roubini said.

A ?perfect storm? of fiscal woe in the U.S., a slowdown in China, European debt restructuring and stagnation in Japan may converge on the global economy, New York University professor Nouriel Roubini said.

There?s a one-in-three chance the factors will combine to stunt growth from 2013, Roubini, who predicted the global financial crisis, said in a June 11 interview in Singapore. Other possible outcomes are ?anemic but OK? global growth or an ?optimistic? scenario in which the expansion improves.

?There are already elements of fragility,? he said. ?Everybody?s kicking the can down the road of too much public and private debt. The can is becoming heavier and heavier, and bigger on debt, and all these problems may come to a head by 2013 at the latest.?

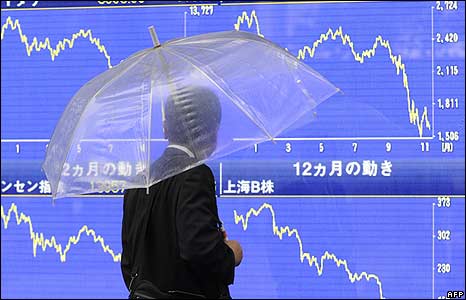

Elevated U.S. unemployment, a surge in oil and food prices, rising interest rates in Asia and trade disruption from Japan?s record earthquake threaten to sap the world economy. Stocks worldwide have lost more than $3.3 trillion since the beginning of May, and Roubini said financial markets by the middle of next year could start worrying about a convergence of risks in 2013.

The MSCI AC World Index has tumbled 4.7 percent this month on concern recent data, including an increase in the U.S. unemployment rate to 9.1 percent in May, signal the global economy is losing steam. U.S. Treasuries rose last week, pushing two-year note yields down for a ninth week in the longest stretch of decreases since February 2008, on bets the Federal Reserve will maintain monetary stimulus.

Bond Market ?Revolt?

World expansion may slow in the second half of 2011 as ?the deleveraging process continues,? fiscal stimulus is withdrawn and confidence ebbs, Roubini also said.

In the U.S., a failure to address the budget deficit risks a bond market ?revolt,? Roubini said. President Barack Obama?s administration has been negotiating with Republicans, who control the House of Representatives, over cutting the federal government?s long-term shortfall and raising the debt ceiling.

?We?re still running over a trillion-dollar budget deficit this year, next year and most likely in 2013,? Roubini said in a speech in Singapore on June 11. ?The risk is at some point, the bond market vigilantes are going to wake up in the U.S., like they did in Europe, pushing interest rates higher and crowding out the recovery.?

In Europe, officials need to restructure the debt of Greece, Ireland and Portugal, and waiting too long may result in a ?more disorderly? process, Roubini also said.

Greece?s Struggle

European officials are racing to find a plan to stem Greece?s debt crisis by June 24 while sharing the cost of a new rescue with bondholders. Saddled with the euro area?s heaviest debt load, Greece is seeking additional loans after last year?s 110 billion-euro ($159 billion) bailout.

Japan?s economy, the world?s third-largest, slid into a recession last quarter after the March 11 earthquake and tsunami and ensuing nuclear crisis. The government is spending an initial 4 trillion yen ($50 billion) to clean up from the disaster, which is estimated to have caused as much as 25 trillion yen in economic damage.

Bank of Japan Governor Masaaki Shirakawa said on June 1 that supply constraints are easing faster than expected as companies rush to repair their facilities. The risk in Japan is ?if growth fizzles out after a short-term reconstruction stimulus,? leading to a renewed struggle to maintain expansion around 2013, Roubini said.

China?s economy may face a ?hard landing? after 2013 as government efforts to boost growth through investment cause excess capacity, Roubini told reporters.

?Overcapacity? in China

?China is now relying increasingly not just on net exports but on fixed investment? which has climbed to about 50 percent of gross domestic product, he said. ?Down the line, you are going to have two problems: a massive non-performing loan problem in the banking system and a massive amount of overcapacity is going to lead to a hard landing.?

A record $2.7 trillion of loans were extended in China over two years, pushing property prices to all-time highs even as authorities set price ceilings, demanded higher deposits and limited second-home purchases.

The nation?s current challenge is to maintain growth and curb price gains ahead of a leadership change next year, Roubini said. Officials may use administrative steps and price controls, as well as raising rates further and allowing currency appreciation, if inflation becomes a bigger problem, he said.

?The policy challenge through next year, where you have a delicate political transition of the leadership, is to maintain growth in the 8 to 9 percent range while pushing inflation below what it is right now,? said Roubini, the co-founder and chairman of New York-based Roubini Global Economics LLC.

After next year, the bigger challenge in China is ?to reduce fixed investment and savings and increase consumption. Otherwise after 2013, there will be a hard landing,? he said.

Roubini in July 2006 predicted a ?catastrophic? global financial meltdown that central bankers would be unable to prevent. The collapse of Lehman Brothers Holdings Inc. in 2008 sparked turmoil that led to the worst financial crisis since the 1930s.

To the verse 21 I like to write you the Luther translation. In English translations it says: ?? to whom they shall not give the honor of the kingdom.? Luther translated that this way: ??to whom the honor of the throne was not meant to be placed upon.?

In a new German Bible translation it says it similar: ?..who is not a rightful successor of the throne.?

That gives more thoughts of what kind of person he will be.

When it says there “…like they did in Europe, pushing interest rates higher and crowding out the recovery,? and then, almost at the end of the article, “Officials may use administrative steps and price controls, as well as raising rates further and allowing currency appreciation…” These reminds me of a verse I read recently in the Bible “Then shall stand up in his estate a raiser of taxes in the glory of the kingdom: but within few days he (or it) shall be destroyed, neither in anger, nor in battle.” –Daniel 11:20

Interesting point & it’s interesting in the next verse 21 is the rise of the Antichrist. “And in his estate shall stand up a vile person, to whom they shall not give the honour of the kingdom: but he shall come in peaceably, and obtain the kingdom by flatteries.” It’s also interesting that besides raising taxes they are also implementing austerity measures in Europe & of course this will happen in the USA. So we’re seeing demonstrations & riots in Greece, Spain & other countries because of these economic policies. The antichrist economic plan is to share the wealth as brought in verse 24. “He shall enter peaceably even upon the fattest places of the province; and he shall do that which his fathers have not done, nor his fathers’ fathers; he shall scatter among them the prey, and spoil, and riches:…” That one of the reasons that he will be so popular!